Harbor Consensus Highlights – Q1 2024

Harbor Investment Partners Skew Bullish on the U.S. for 2024

April 18, 2024.png)

Underscoring the U.S.

At the heart of Harbor’s DNA is our focus on hand-selecting and vetting investment teams with differentiated approaches. Each quarter, Harbor conducts the Harbor Consensus, a survey of our investment partners, which most recently showed fervent enthusiasm for the prospects in the U.S. over the next 12 months. In the chart below, we observed that managers exhibited a strong favorability towards the U.S. and simultaneous aversion towards Western Europe when asked to identify two global regions they expected to outperform and underperform over the next 12 months.

Source: Harbor Consensus Survey Q12024.

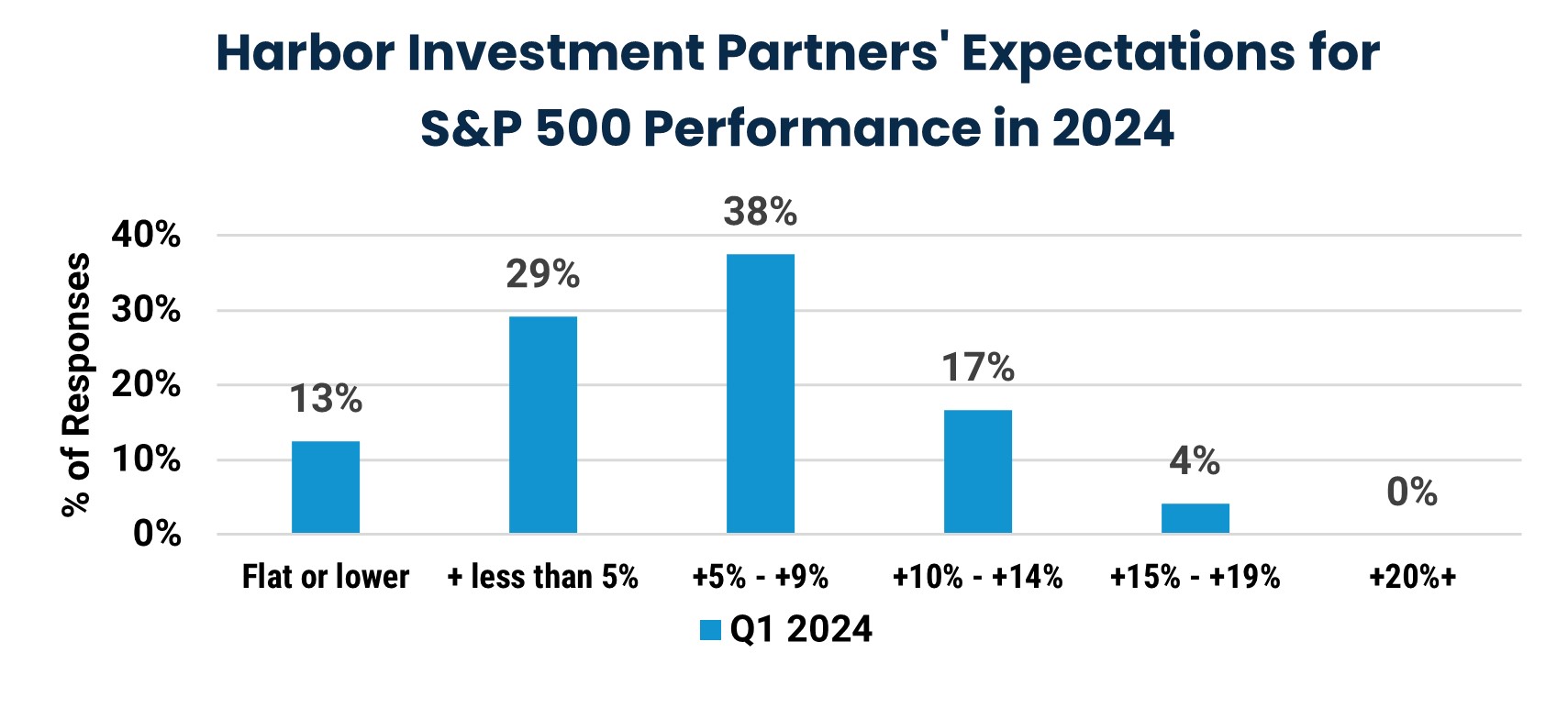

This bullish mentality towards the U.S. was also evident in our assessment of managers’ U.S. equity outlook for 2024, with the S&P 500 serving as proxy. A notable 87% of respondents expect the S&P 500 to finish higher in 2024, with nearly 60% anticipating returns between +5% and +19%.

Source: Harbor Consensus Survey Q12024.

Figuring Out the Fed

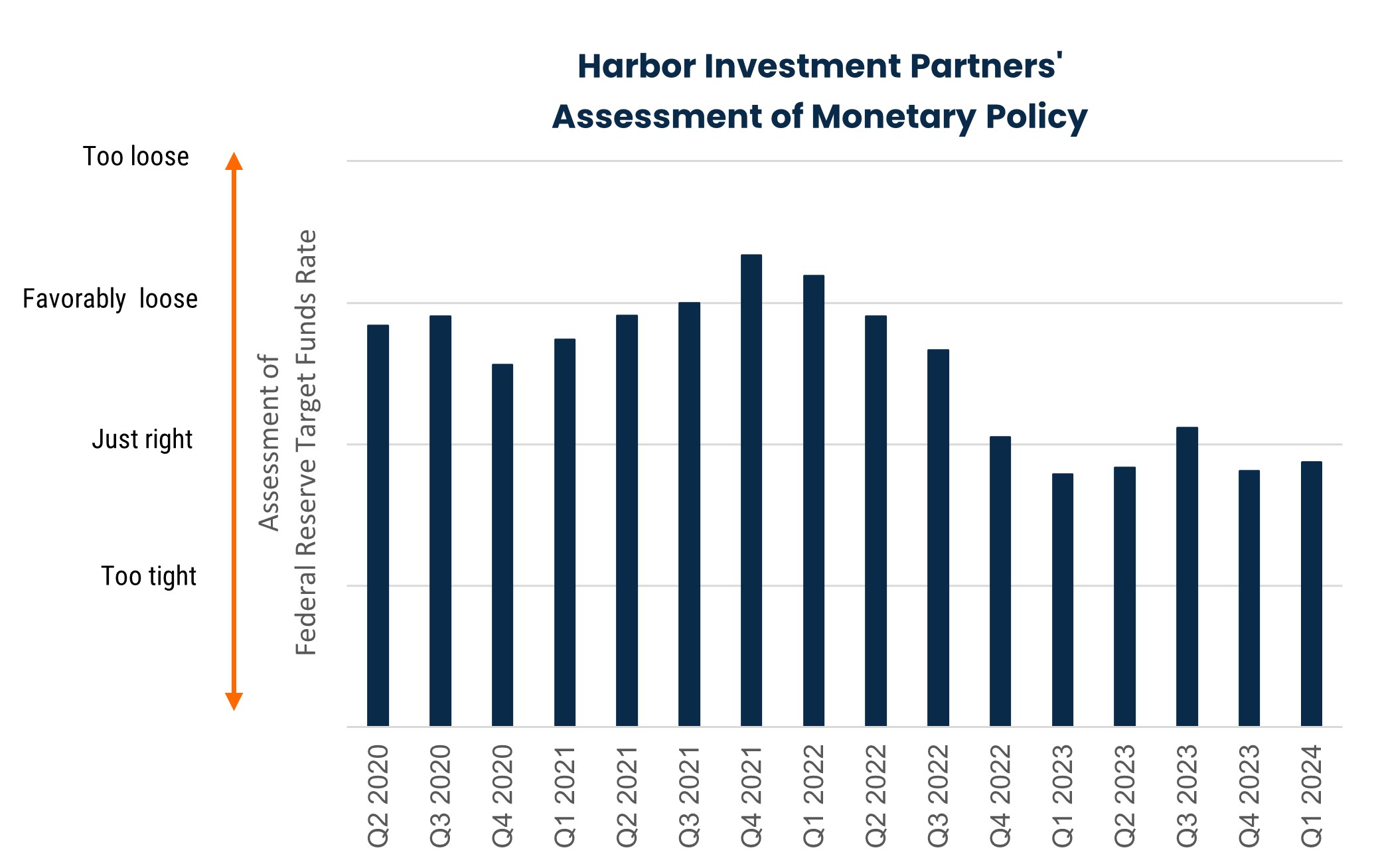

Harbor’s affiliates also marked the sixth quarter in a row with a favorable opinion of the Fed’s approach to monetary policy, deeming it “just right” as exhibited below.

Source: Harbor Consensus Survey Q22020 - Q12024.

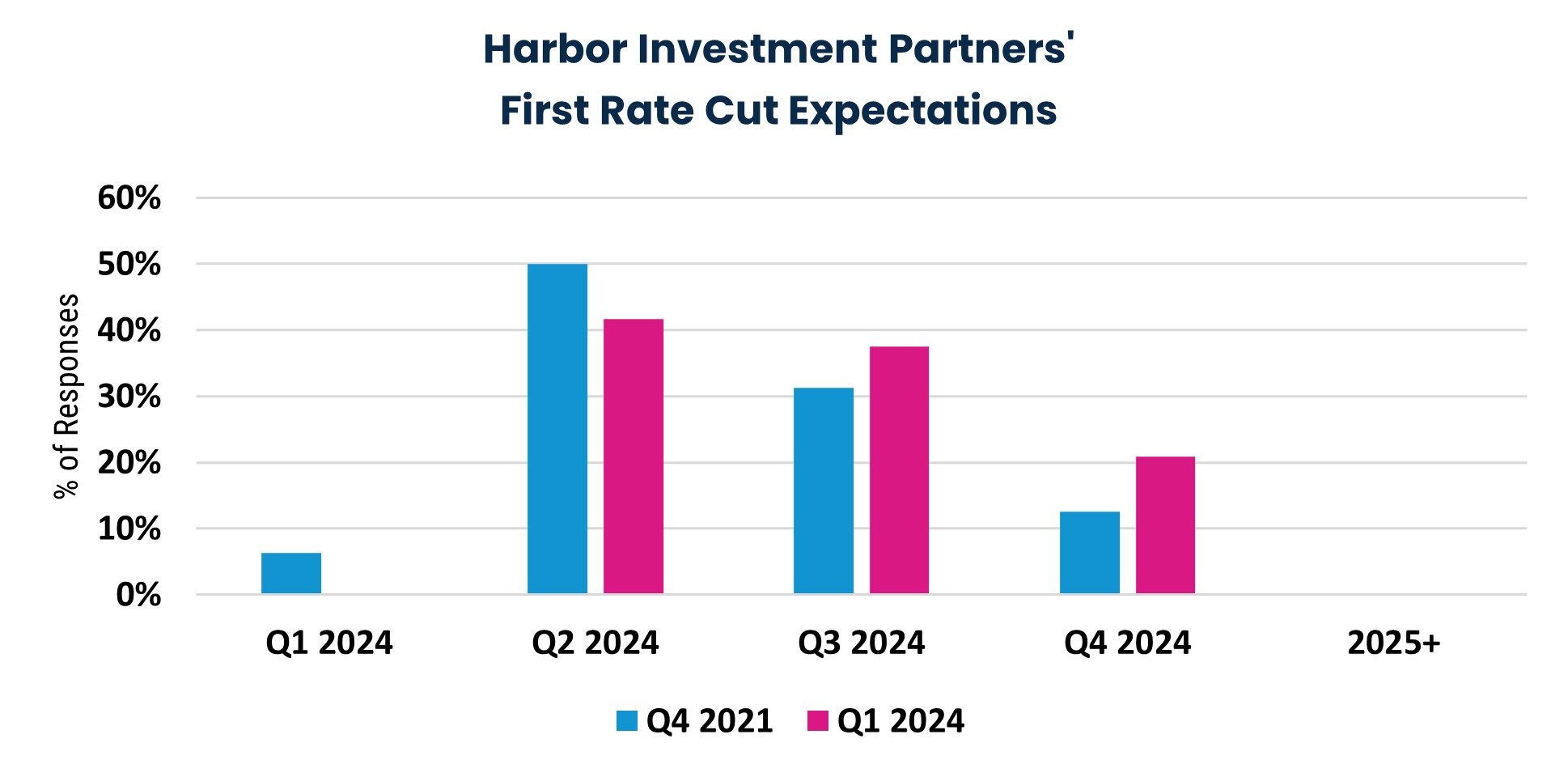

In terms of expectations for the Fed’s first rate cut, managers accurately surmised that the Fed would not act in the first quarter. Subsequently, the tail on expectations for first rate cut date widened throughout 2024, with roughly 60% of respondents now anticipating a first rate cut in the second half of 2024.

Source: Harbor Consensus Survey Q42023 & Q12024.

Inflation Navigation

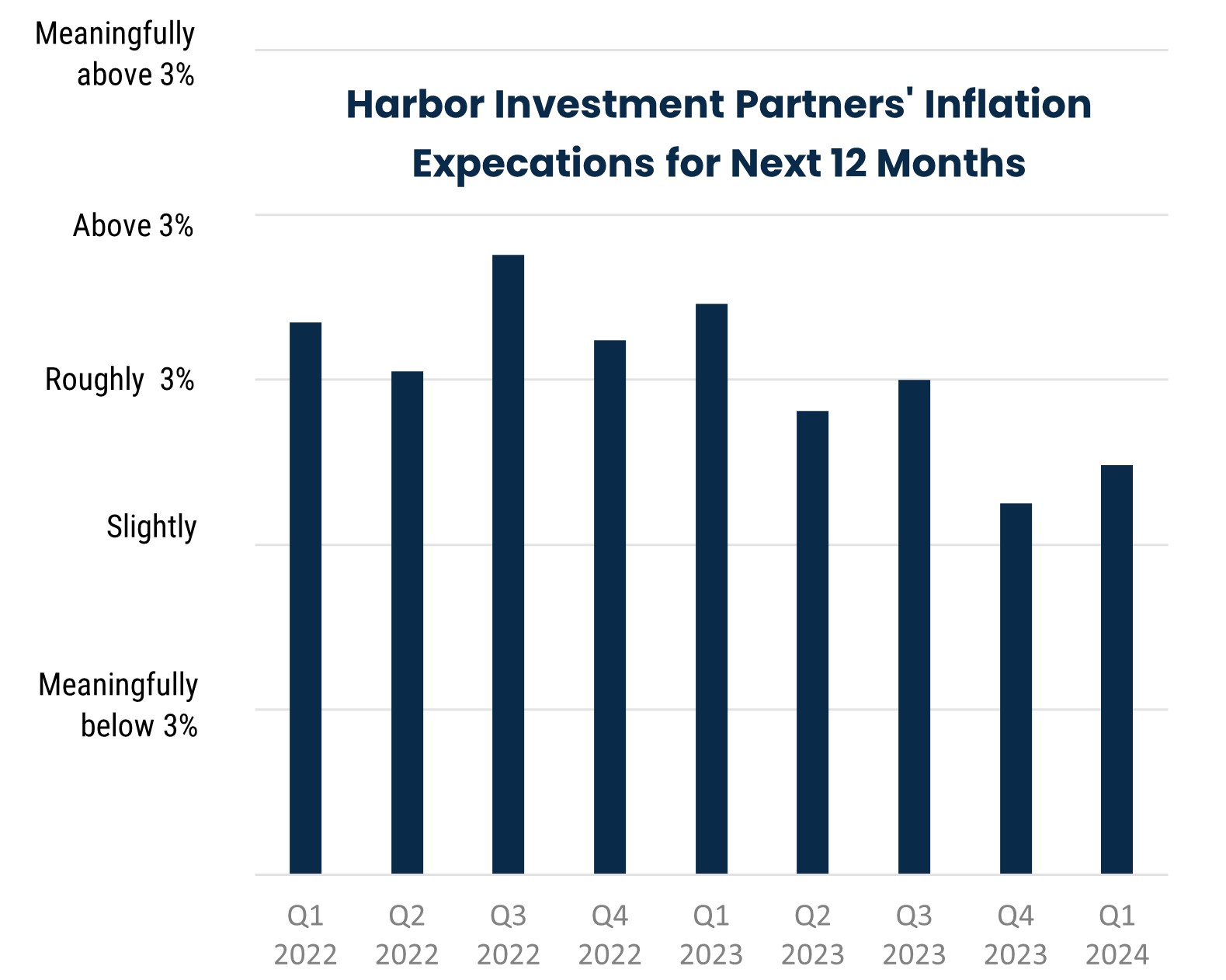

Moreover, the majority of these managers continue to believe the Fed’s approach will coax inflation down towards the 3% threshold or lower over the next 12 months. This represents a shift from 2022 and early 2023 when our affiliates expressed an expectation for at least 3% inflation in the upcoming 1-year period.

Source: Harbor Consensus Survey Q12022 - Q12024.

Thinking Outside the Box

Although common threads abounded in our Q12024 Harbor Consensus, managers provided their “out of consensus” calls for 2024. This serves as a reminder that the global investment landscape is a complex space with a multitude of considerations always at play.

Size & Style | "Small Caps could outperform at least half of the Mag 7" "Long Value stocks/securities" "Buying companies that have operational blow ups and change management" |

Sector & Industry | "Valuations in Large Cap Tech may not be too high" ""The Magnificent 7 could underperform" "Long old media" "The combination of undervalued stocks, underinvestment in development and expected demand growth make energy companies very attractive" |

Global Outlooks | "Potential for larger rally in the Dollar in the Dollar in Q424 due to continued outperformance of US vs Europe and EME later in the year" "We are of the opinion that the U.S. economy will remain a the forefront of global growth over the next year, buoyed by the resilience of consumer robust corporate fundamentals, abundant liquidity, and anticipated interest rate reductions in the second half of 2024" "We continue to express a more cautious view on interest rate risk in Japan given the recent and anticipated steps in the direction of monetary policy normalization as inflation pressures continue to represent a challenge to the economy" "Europe could slip into deflation" |

Conclusions

All things considered, these survey responses suggest to us that the majority of Harbor’s investment partners believe the Fed has taken appropriate action in its effort to drive down inflation in the U.S. in the last several quarters. In its own current outlook, Harbor’s Multi-Asset Solution Team (MAST) expressed a similar sentiment, noting that:

- recession obsession is giving way to optimism after the Fed’s December pivot

- there is ample room to run if the U.S. economy realizes a soft landing

- market internals have shifted towards more cyclical and risk-on positioning

For more details on MAST’s thinking, please visit our website.

The Harbor Consensus

Rigorous manager selection has been central to Harbor’s mission since its founding four decades ago. We partner with managers that we view as best-in-class, and we have a great deal of respect for their investment views. To harness this wealth of knowledge and experience, Harbor’s investment team surveys our investment partners quarterly for their views on a variety of investment topics. Most questions are standard from quarter to quarter, allowing us to examine how the managers’ views evolve over time. We also include one or two special questions each quarter, to gauge our partners’ views on relevant topics of the day. The survey responses are gathered into The Harbor Consensus, which is one input into the mosaic of information that Harbor’s Multi-Asset Solutions Team uses to develop its own asset allocation views.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice. This material is for informational and illustrative purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Polling: The above mentioned were Harbor created polls conducted as part of the Q12024 Harbor Consensus. Respondents consisted of subadvisors, affiliates with the group trust, and other investment groups that work with Harbor Capital who were invited to participate in the survey. There were a total of 24 participants. For the leaders/laggards polling question (first chart), 24 participants responded. For the S&P 500 expectations polling question (second chart), 24 participants responded. For the assessment of monetary policy polling question (third chart), 23 participants responded. For the first rate cut polling question (fourth chart), 24 participants responded. For the inflation expectation polling question (fifth chart), 23 participants responded.

3519745